nc sales tax on food items

Line 9 - 2 County Rate. Sales taxes are not charged on services or labor.

Is Food Taxable In North Carolina Taxjar

105-1643 is subject to the 2 rate of tax.

. Food Tax The 2 Food Tax. Exemptions to the North Carolina sales tax will vary by state. It is not intended to cover all provisions of the law or every taxpayers specific circumstances.

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. North Carolina sales tax rates vary depending on which county and city youre in which can make finding the. Exemptions to the North Carolina sales tax will vary by state.

Sales and Use Tax Rates. While the North Carolina sales tax of 475 applies to most transactions there are certain items that may be exempt from taxation. Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items Subject to the 7 Combined General Rate Items Subject to a Miscellaneous Rate Sales and Use Taxes Imposed in Addition to the Rates Listed Above Other Information.

But youd only charge the uniform reduced rate of 2 local tax on the loaf of bread. Search local rates at TaxJars Sales Tax Calculator Any food items ineligible for the reduced rate are taxed at the regular state rate. The state sales tax rate in North Carolina is 4750.

Municipal governments in North Carolina are also allowed to collect a local-option sales tax that ranges from 2 to 275 across the state with an average local tax of 222 for a total of 697 when combined with the state sales tax. Free Unlimited Searches Try Now. In some states items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a.

Find your North Carolina combined state and local tax rate. North Carolina Department of Revenue. To learn more see a full list of taxable and tax-exempt items in North Carolina.

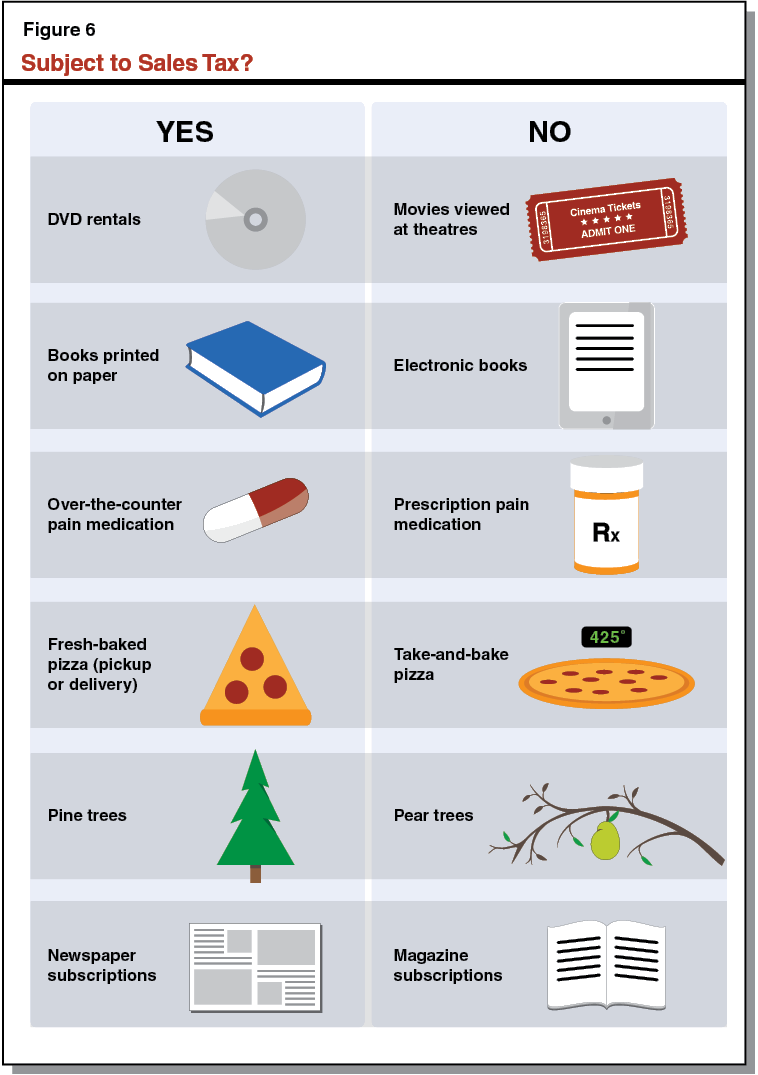

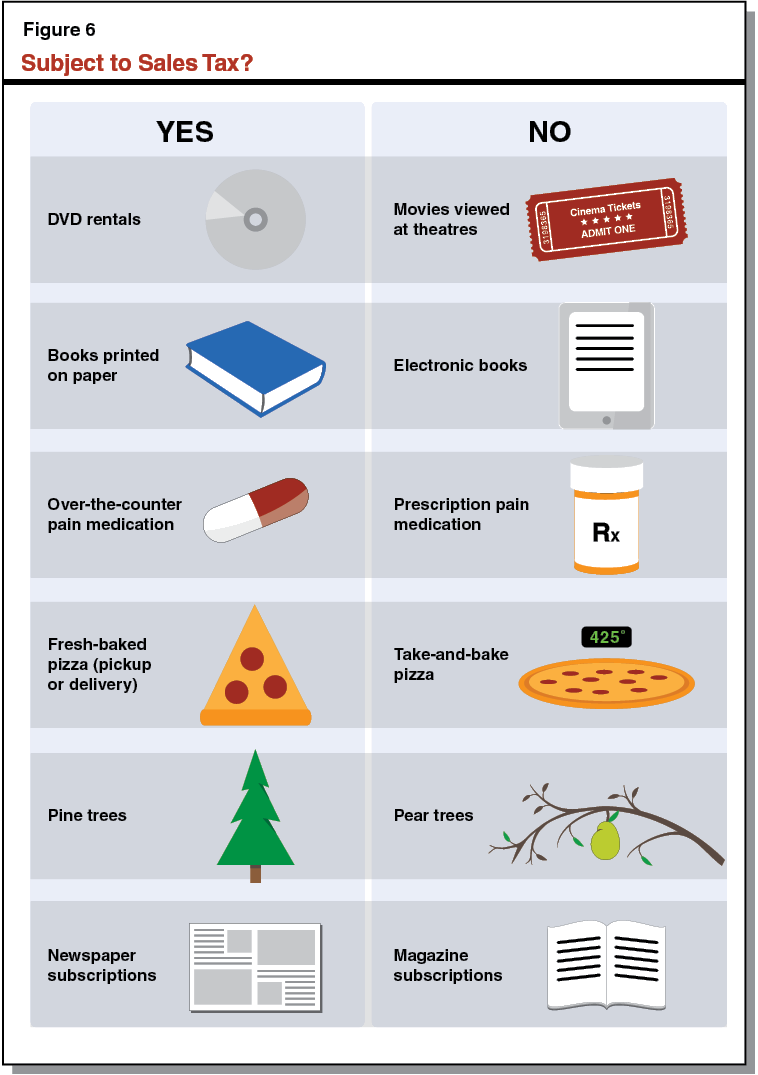

This page discusses various sales tax exemptions in North Carolina. Bakery items sold with eating utensils soft drinks and candy. The taxes listed below are administered by the Sales and Use Tax Division.

According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC state rate and 225 Cherokee County rate on the toothbrush and the candy. Food Non-Qualifying Food and Prepaid Meal Plans. The general State rate of tax is 475 and the applicable local and transit rates of sales and use tax vary depending on the local jurisdiction where a sale is sourced.

Ad Get North Carolina Tax Rate By Zip. Select the North Carolina city from the list of popular cities below to. The sales tax rate on food is 2.

Line 8 - 2 Food Rate. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax. Exemptions to the North Carolina sales tax will vary by state.

Lease or Rental of Tangible Personal Property. The information included on this website is to be used only as a guide. Sales taxes are not charged on services or labor.

Items subject to the general rate are also subject to the 225 local rate of tax that is levied by all counties in North Carolina. With local taxes the total sales tax rate is between 6750 and 7500. Click on the tax to review the law on the General Assemblys web site.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The sale of prepared food is subject to general State rate of tax of 4. In some states items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a.

A 2 local rate of tax applies to the sales price of food products that are exempt from State tax. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. This page describes the taxability of food and meals in North Carolina including catering and grocery food.

Items subject to the general rate Line 4 are also subject to the local rate of sales and use tax except for the following. Items subject to the general rate are also subject to the 225 local rate of tax that is levied by all counties in North Carolina. Sales Tax Exemptions in North Carolina.

PO Box 25000 Raleigh NC 27640-0640. A customer buys a toothbrush a bag of candy and a loaf of bread. North Carolina has a statewide sales tax rate of 475 which has been in place since 1933.

The base state sales tax rate in North Carolina is 475. Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax.

A manufactured home a modular home an aircraft and a qualified jet engine. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax. In North Carolina certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Sales and Use Tax Sales and Use Tax. The 475 general sales rate tax plus local taxes including the transit and Article 46. Arizona grocery items are tax exempt.

Food Non-Qualifying Food and Prepaid Meal Plans. Arkansas Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15 any local rate. In some states items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75. The sale of food at retail as defined in NC.

North Carolina has recent rate changes Fri Jan 01 2021. North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222. Is Food Exempt from Sales Tax.

The sales tax rate on food is 2.

Here S A Tax Guide For Nuts Wsj

Tax Free Weekend Guide By State 2022 Direct Auto

Is Food Taxable In North Carolina Taxjar

Taxes On Food And Groceries Community Tax

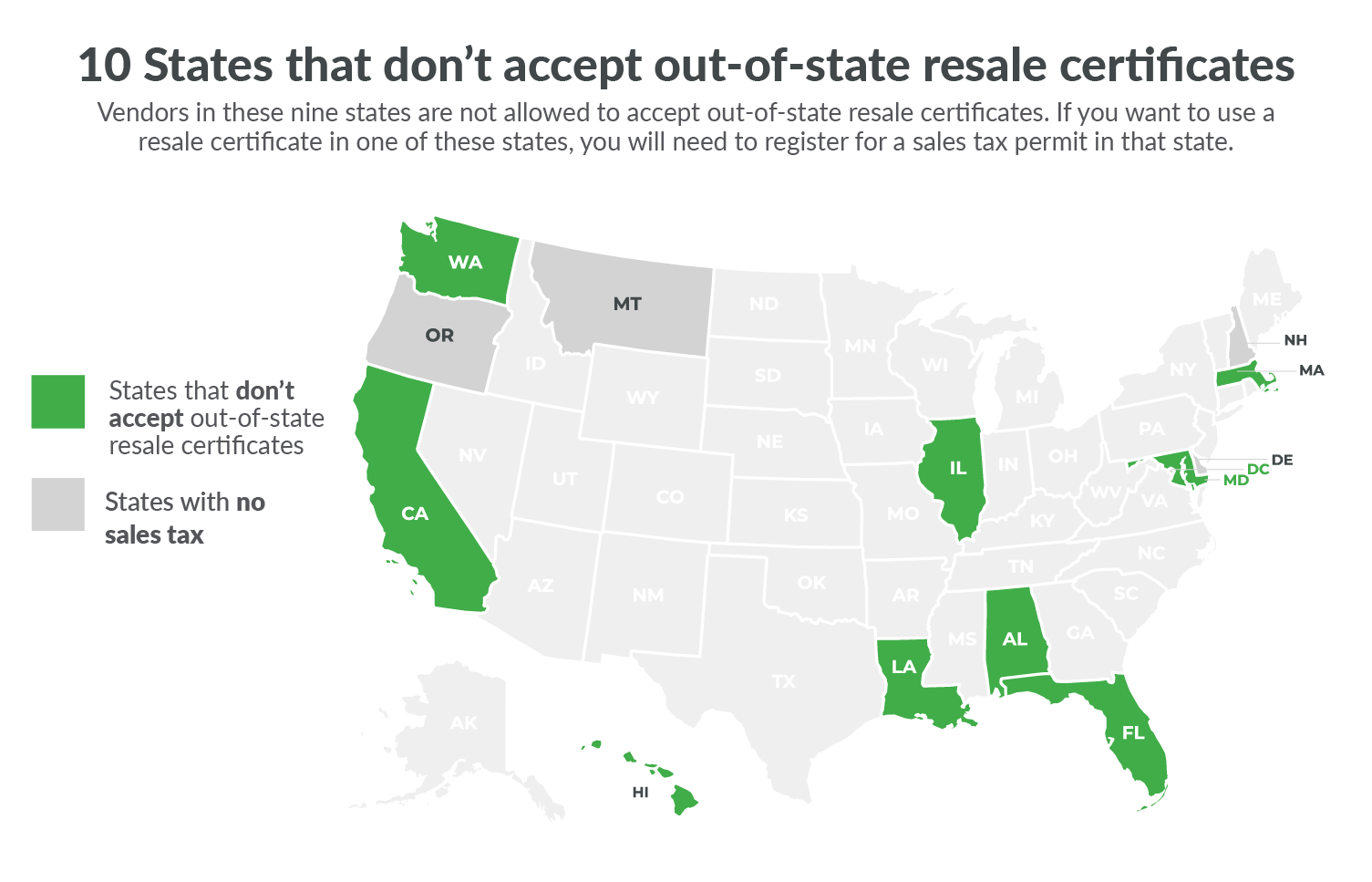

10 States That Won T Accept Your Out Of State Resale Certificate Taxjar

Understanding California S Sales Tax

Sales Tax On Grocery Items Taxjar

Sales Tax On Grocery Items Taxjar

Flush States May Exempt Food From Sales Tax

Understanding California S Sales Tax

Stunt Foods Food Articles Food Innovation Fast Food Items

Is Food Taxable In North Carolina Taxjar

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Arizona Sales Tax Small Business Guide Truic

Epcot Festival Of The Arts Information Epcot Festival Food Network Recipes

Sales Tax Holidays Politically Expedient But Poor Tax Policy